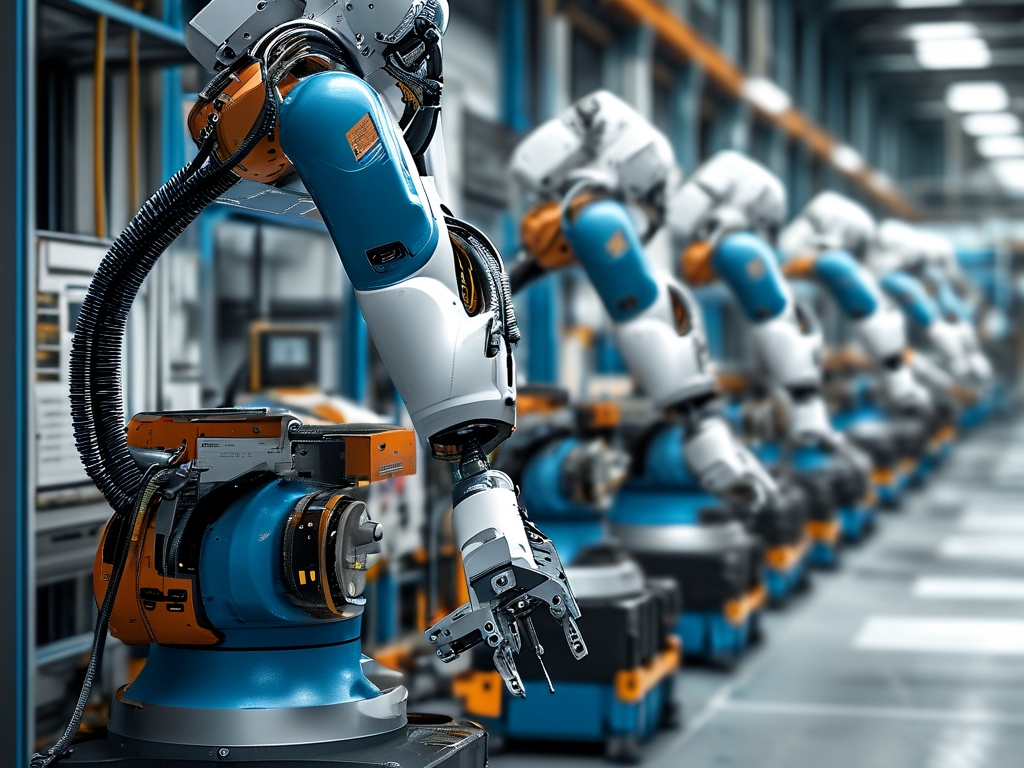

The global adoption of industrial robots has surged over the past decade, with imported robotics systems playing a pivotal role in manufacturing, healthcare, and logistics. However, as these advanced machines become integral to operational efficiency, the demand for specialized maintenance technologies has grown exponentially. This article explores the evolving landscape of imported robot repair techniques, their technical complexities, and the strategies industries employ to ensure seamless operations.

The Rise of Imported Robotics

Modern industries increasingly rely on high-precision robots from leading manufacturers in Japan, Germany, and the United States. Brands like Fanuc, KUKA, and ABB dominate markets with their cutting-edge automation solutions. While these robots enhance productivity, their sophisticated designs require equally advanced maintenance protocols. Unlike conventional machinery, imported robots often integrate proprietary software, custom sensors, and modular components, making repairs without OEM (Original Equipment Manufacturer) support challenging.

Technical Complexities in Maintenance

- Proprietary Software Barriers: Many imported robots operate on closed-loop software systems. Accessing diagnostic tools or firmware updates typically requires authorization from the manufacturer. This creates delays in troubleshooting, especially for companies lacking formal service agreements.

- Component Sourcing: Replacement parts for imported robots often have long lead times due to supply chain dependencies. For instance, a damaged harmonic drive in a Japanese-made robotic arm might take weeks to arrive, halting production lines.

- Skill Gaps: Local technicians may lack training in niche systems. A German collaborative robot (cobot) with force-sensitive actuators demands expertise absent in generic robotics courses.

Innovations in Repair Technologies

To address these challenges, third-party service providers and in-house engineering teams are developing innovative solutions:

- Reverse Engineering: By analyzing failed components, technicians recreate compatible parts using 3D printing and CNC machining. For example, a Chinese automotive plant recently replicated a Swiss-made gripper mechanism at 40% of the OEM cost.

- AI-Driven Diagnostics: Machine learning algorithms now predict failures by analyzing vibration patterns and thermal data. Companies like Uptake Technologies offer platforms that reduce downtime by 30% in imported robotic systems.

- Hybrid Training Programs: Partnerships between robot manufacturers and vocational institutes are bridging skill gaps. Siemens, for instance, certifies technicians in its proprietary maintenance protocols through global academies.

Case Study: Overcoming Supply Chain Hurdles

A South Korean electronics manufacturer faced repeated breakdowns in its imported wafer-handling robots. With OEM support delayed by geopolitical trade restrictions, the company collaborated with a local university to develop a modular repair kit. The kit included 3D-printed adapters and open-source software patches, cutting repair costs by 55% and reducing downtime from 14 days to 48 hours.

The Role of Predictive Maintenance

Preventive approaches are gaining traction. Sensors embedded in robot joints collect real-time data on wear and tear, enabling timely interventions. For instance, Tesla's Gigafactories use vibration analysis tools to service imported assembly robots before critical failures occur. This shift from reactive to predictive maintenance is projected to save industries $630 billion annually by 2025 (McKinsey Report, 2023).

Regulatory and Cost Considerations

Importing repair technologies also involves navigating tariffs and compliance standards. The European Union's CE marking requirements, for example, mandate that refurbished robotic parts meet strict safety benchmarks. Additionally, companies must weigh the costs of training staff versus outsourcing repairs. A cost-benefit analysis by Deloitte revealed that in-house expertise pays off within 18 months for firms operating over 50 imported units.

Future Trends

- Blockchain for Parts Tracing: Distributed ledger technology will enhance transparency in the supply chain, ensuring authentic components.

- Augmented Reality (AR) Repairs: Technicians using AR glasses could receive real-time guidance from OEM engineers, reducing errors.

- Standardized Protocols: Industry alliances are pushing for universal repair standards to simplify cross-brand maintenance.

Imported robot maintenance is no longer a peripheral concern but a strategic imperative. As technologies evolve, businesses must invest in adaptive repair strategies, workforce training, and collaborative ecosystems. By embracing innovation, industries can transform maintenance challenges into opportunities for growth, ensuring that their high-value robotic assets operate at peak efficiency for decades.