Fuzhou’s Emergence in the Global Embedded Systems Landscape

In recent years, Fuzhou, the capital of Fujian Province, has quietly transformed into a critical hub for embedded systems development and semiconductor innovation. Home to a growing cluster of specialized companies, the city is leveraging its strategic location, government support, and talent pool to carve out a niche in the competitive global chip industry. This article explores how Fuzhou-based embedded development companies are driving technological advancements, fostering partnerships, and addressing challenges in an era of rapid digital transformation.

The Embedded Systems Ecosystem in Fuzhou

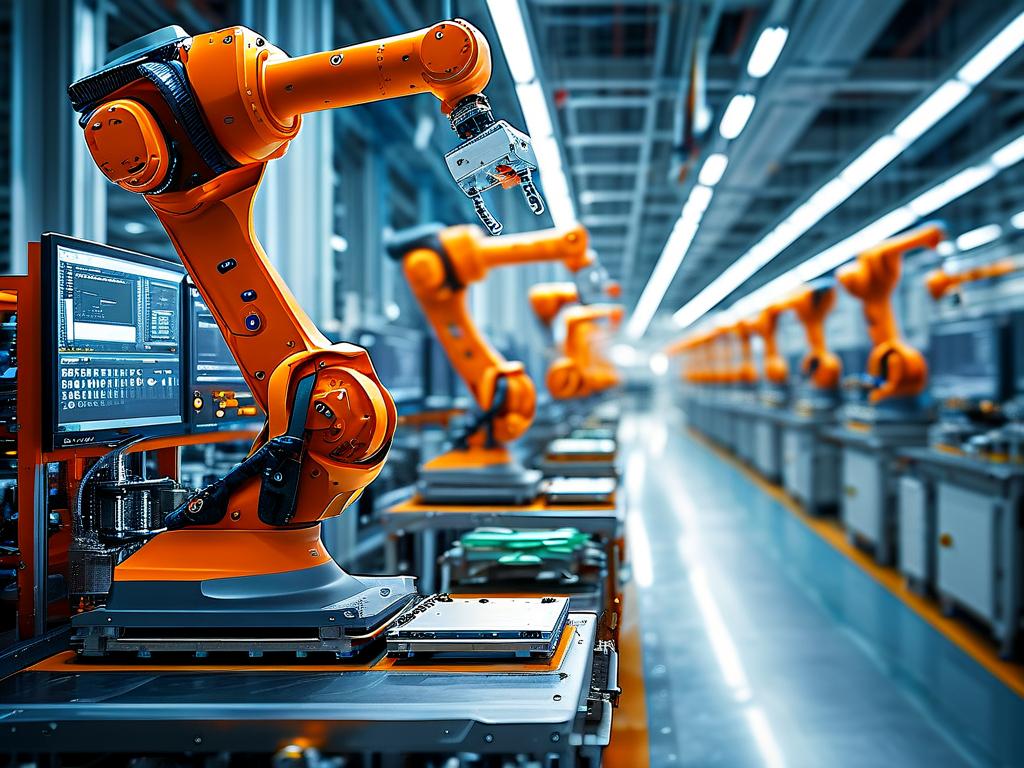

Fuzhou’s embedded development sector thrives on a unique ecosystem that integrates hardware design, software engineering, and advanced manufacturing. Companies like Fujian Silicon Dynamics and Fuzhou TechCore have emerged as pioneers, focusing on low-power IoT chips, edge computing solutions, and AI-integrated microcontrollers. These firms collaborate with local universities, such as Fuzhou University and Fujian Normal University, to bridge academic research with industrial applications. For instance, a 2023 joint project between TechCore and Fuzhou University resulted in a neural processing unit (NPU) optimized for smart city sensors, reducing energy consumption by 40% compared to previous models.

The city’s proximity to Taiwan’s semiconductor giants has also played a pivotal role. Cross-strait partnerships enable knowledge transfer and supply chain integration, particularly in advanced packaging technologies. Meanwhile, Fuzhou’s Free-Trade Zone offers tax incentives and streamlined customs processes, attracting multinational corporations like Siemens and Bosch to establish R&D centers focused on industrial automation and automotive embedded systems.

Innovations Driving Market Competitiveness

Fuzhou-based companies are distinguishing themselves through three key innovations:

-

AI-Edge Convergence: Startups like NeuraChip are designing embedded chips that combine machine learning accelerators with real-time data processing capabilities. Their flagship product, the NC-300 series, powers intelligent surveillance systems across Southeast Asia, processing video analytics locally to minimize latency and bandwidth costs.

-

Sustainable Hardware: With global emphasis on green technology, Fuzhou’s EcoEmbed has developed solar-powered embedded controllers for agricultural IoT devices. These chips, manufactured using 28nm FD-SOI technology, operate reliably in harsh environments while maintaining a carbon footprint 35% lower than industry averages.

-

Open-Source Collaboration: Breaking from traditional models, Fuzhou OSHub launched an open-source embedded platform in 2022, allowing developers worldwide to co-design modular chip architectures. This initiative has accelerated time-to-market for niche applications, from marine robotics to wearable medical devices.

Challenges and Strategic Responses

Despite progress, Fuzhou’s embedded chip companies face hurdles. The U.S.-China tech rivalry has complicated access to cutting-edge EDA tools and semiconductor equipment. In response, firms are diversifying suppliers—adopting hybrid workflows that combine imported photolithography machines with domestically developed etching systems. Additionally, local authorities have allocated ¥2.1 billion (2023–2025) to subsidize homegrown IP core development, aiming to reduce reliance on ARM and RISC-V architectures.

Talent retention remains another concern. While Fuzhou’s lower living costs compared to Shanghai or Shenzhen attract engineers, companies must compete with coastal megacities. Innovative solutions include “remote co-design” programs, where engineers in Fuzhou collaborate with global teams via cloud-based EDA platforms, blending local affordability with international expertise.

Future Outlook: Positioning in the Global Value Chain

Industry analysts predict Fuzhou’s embedded sector will grow at a CAGR of 12.8% through 2030, outpacing China’s national average of 9.3%. Upcoming projects signal ambitious goals:

- Quantum-Embedded Hybrid Systems: Fuzhou’s QTech Labs is experimenting with cryogenic CMOS chips to interface quantum processors with classical embedded controllers, targeting breakthroughs in secure communications.

- Automotive Grade Chips: With China’s EV boom, firms like AutoFuzhou Semiconductors are developing ASIL-D certified embedded MCUs for autonomous driving systems, partnering with BYD and NIO.

However, success will hinge on navigating geopolitical risks and doubling down on niche markets where Fuzhou holds comparative advantages—such as marine electronics and cross-strait industrial IoT.

Fuzhou’s embedded development companies exemplify how regional hubs can disrupt global tech hierarchies through focused specialization, academic-industrial synergy, and adaptive strategies. While challenges persist, the city’s blend of innovation, cost efficiency, and strategic partnerships positions it as a rising star in the embedded systems arena—one that could redefine China’s role in the semiconductor value chain. As the world races toward an interconnected future, Fuzhou’s chip pioneers are proving that geographical size matters less than the ability to innovate smartly and sustainably.